Topo

Opening a business in France : Main topics to be considered

Date de publication : 29.10.21

France is one of the largest country of the European Union. Its economy is well developed and, as such, it is one of the main countries chosen for direct foreign investments in the world. France provides a business-friendly environment with strong public facilities and a legal framework in line with European standards.

If you are looking at starting a business, France has made it easier for foreign residents to pursue their entrepreneurial project. We will focus in this article on four significant topics to be considered :

• Entering the French market – Structuring aspects

• Specific cross-border issues

• Tax landscape

• Overview of employee’s matters

Entering the French market

Set-up a business in France – General / structuring

In principle, there are no administrative restrictions on foreign investment in France. Whatever your business development strategy is, you will find an appropriate legal structure adapted to your needs.

The structure to be designed will first depend on short-term business goals

- Limited presence for assessing, studying the market

- Local presence for enhancing a business already existing

- Starting or developing commercial operations

- Specific activities not commercial related (e.g. R&D)

But should also consider medium term plans

- Potential partnership

- Evolution of the business model, new businesses

And investor’s expectations

- Administrative cost structure

- Possible optimizations

- Protection from French business financial risks and liabilities

Permanent establishment : Does the French activity planned represents a “Permanent establishment” ?

The permanent establishment (PE) is defined in many countries’ domestic tax laws and double tax treaties. It determines whether a business has sufficient activity in another territory to create a taxable presence in that other territory from a corporate tax perspective.

Only preliminary and ancillary activities are generally not representing a Permanent establishment Information’s on PE are generally provided in tax bilateral treaties as a fixed presence in France with local resources (employees, equipment’s, etc.) through which the group performs all or a significant part of its activities

Specific exclusions provided in tax bilateral treaties include in particular:

- Installations only for storing, exposing or delivering goods

- Installations for storing goods to be transformed by another company

- Fixed presence only for purchasing materials or gathering information

- Fixed presence for activities preliminary or auxiliary to the commercial activities (market study, preliminary contacts, etc.)

- Construction project lasting less than 6 months or 12 months

This may require specific analysis.

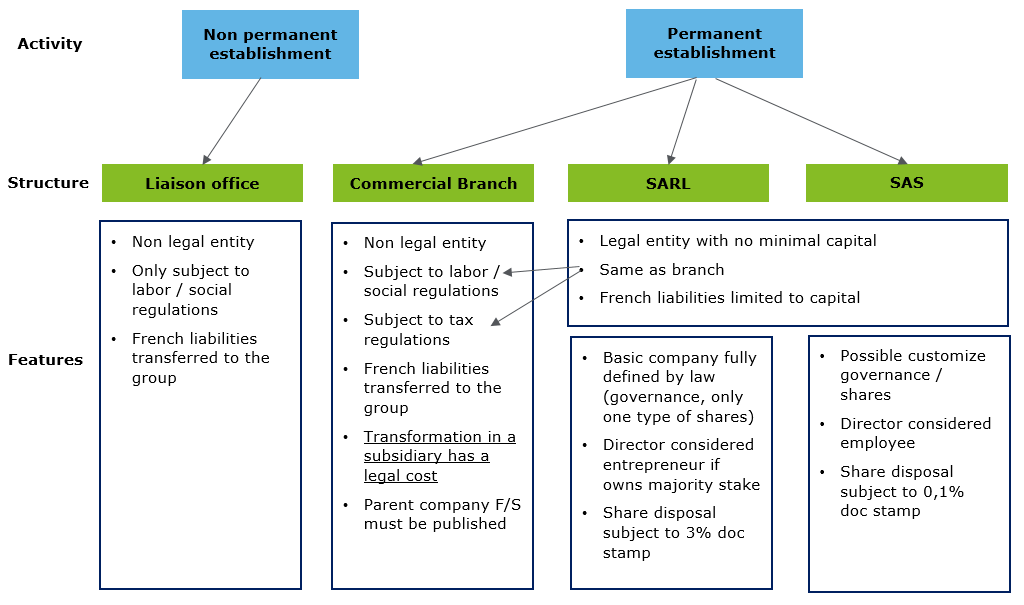

Summary of possible types of structures

Formalities to create a structure

France is known for its complexity in legal matters when setting up a company.

Key steps

Subsidiary : opening a French bank account may take time due to the bank internal control processes, which generally require physical meeting. Working with a bank having operations in France should speed the process.

A lire : Doing business in France: How to create a company, the 5 bullet points

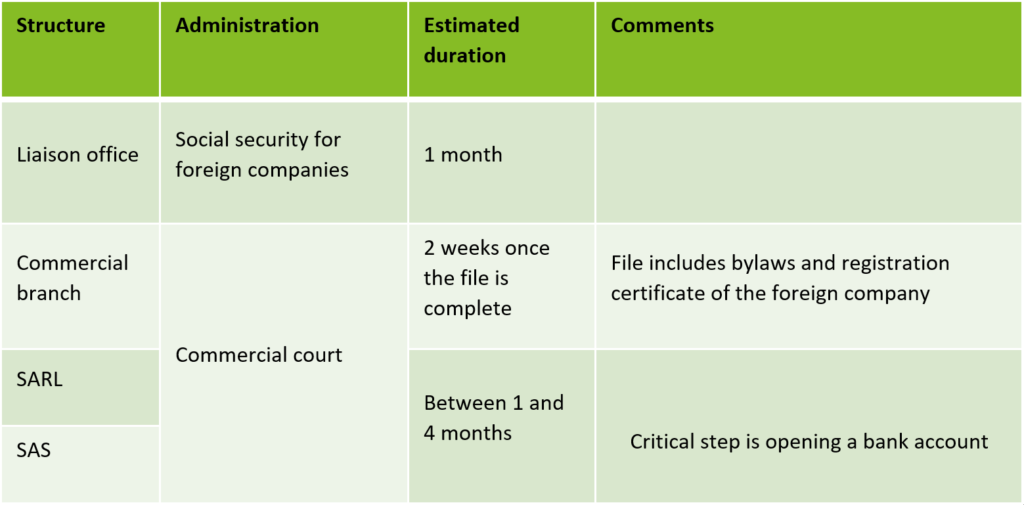

Specific cross border issues

Tax and social security

Bilateral tax treaties in place to avoid double taxations

A bilateral tax treaty is established between two countries for the purpose of avoiding double taxation on their citizens having operations in both countries. When an individual or business earns income or invests in a foreign country, it always raises the question of which country should tax the investor’s earnings.

The bilateral tax treaties are just aimed at clarifying these situations which eventually foster stronger economic, diplomatic, and political ties over the long-run.

France has implemented approximately 130 treaties with different countries with among Argentina, Brazil, Chile, Colombia, Mexico and Venezuela for Latin America, but its treaties cover largely all the continents which frequently make Asian groups to set-up a regional hub in France to operate in Africa.

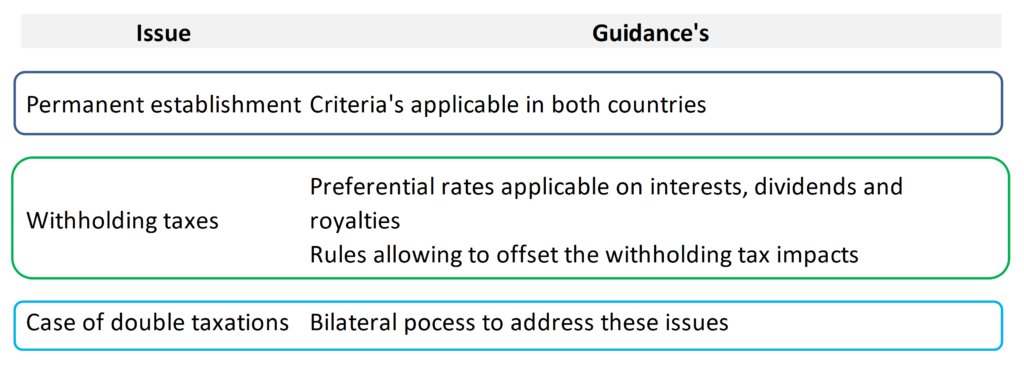

Bilateral social security treaties

They allow sending seconded employees for a limited period of time during which the employee remains subject to the home country social security insurances.

The treaties presented above are only for Latin America. They are plenty others which facilitate the transfer of employees from one country to another and allow to optimize the labor costs.

A lire : Doing business in France: How to create a company, the 5 bullet points

Opening a business in France : specific bilateral issues

Tax and immigration

Transfer pricing

The French business will frequently operate as an integrated piece of its group.

Example : French business sells services / products developed abroad by the group.

When such significant transactions exist, this triggers the following issues :

- What is the French business model within the group (trader, service provider, etc.) ?

- How to address compliance with transfer pricing regulations ?

The intercompany pricing must be justified as being “fair valued” in case of tax audit

Visas

Several types of visas and working permits exist for different situations: employees, managers, investors. They provide in particular :

- Various levels of minimal compensation

- Various durations and extension possibilities

- In certain cases they cover the family as well

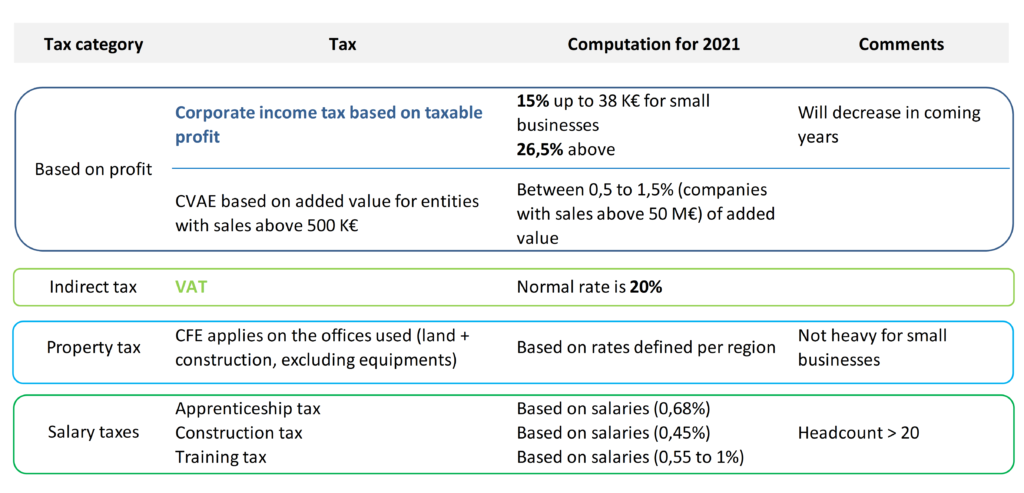

Tax landscape

Other specific taxes exist on company cars, retail locations, pharmaceutical or energy businesses.

Main taxes are CIT and VAT although VAT is normally not a cost for the company

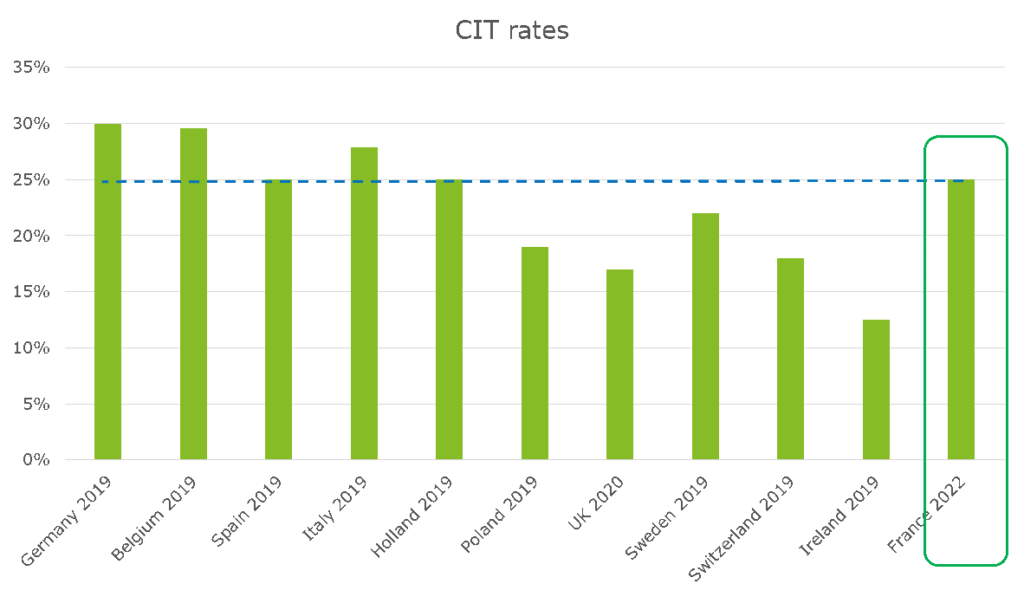

Corporate income tax benchmark

Other aspects

- Production taxes significantly reduced by the finance law for FY21 (3 years exemption for new facilities (subject to specific approvals) and 50 % reduction for existing facilities).

- Significant incentives on R&D activities

- Reduced income tax rate of 10% on intellectual property incomes

- Companies are not taxed on capital gains (company shares) and dividends (Shares representing at least 5% percentage of interest, owned at least since 2 years)

- Tax pooling agreement to offset taxable losses and profits for French related entities (Holding and subsidiaries)

- Tax exemption for expatriates on their expatriation bonus as well on their activity abroad

Overview of employee’s matters

Labor laws are quite extensive and require structured processes aiming at protecting employee’s rights. As long as the processes are complied with the company can manage safely its workforce.

Employment contracts

Main conditions on working hours and minimal salaries are defined by law or the applicable collective bargaining agreement. The usual contract is with undefined term, although in certain circumstances, contracts with defined terms are possible. They include trial periods (from 1 to 4 months) which can be renewed once and during which the contract can be terminated without explanation.

Labor costs

- They represent approximately 1,45 of the gross salary

- Legal minimal salary amounts to 1 540 € per month (not applicable for corporate officers)

Termination

- They can be implemented either based on mutual agreement with the employee, or by the employer justifying professional errors, financial difficulties or incapacity.

- They are subject to defined processes with specific meetings to be arranged with the employee(s).

- Termination costs are based on past years of services

- Liquidated damages are capped since 2018 (depend on past years of services)

Working hours

- Legal duration is 35 hours per week, the additional hours being subject to 25% or 50% increase

- For manager’s positions, and when provided by the collective bargaining agreement, the duration may be counted in days (218 days per year)

- For director’s positions the working hours are not limited

- At company level, possibility to implement flexible working hours scheme on a yearly basis with the approval of the employees (2/3)

À propos de L'auteur

Vous avez aimé cet article, vous avez une question ? Laissez un commentaire