Topo

Overview on French tax system

Date de publication : 23.06.20

In all countries, taxes are always important for investors and entrepreneurs, when planning to entering new markets and developing their businesses. In that respect, French tax system has its downside reputation and is generally viewed as costly and heavy, in particular by countries with a more free market approach (US, UK, South Asia, etc.). The purpose of this presentation is to fairly state the French tax system, how it evolves and compares, in particular with other European countries.

Main taxes applicable in France

Overview

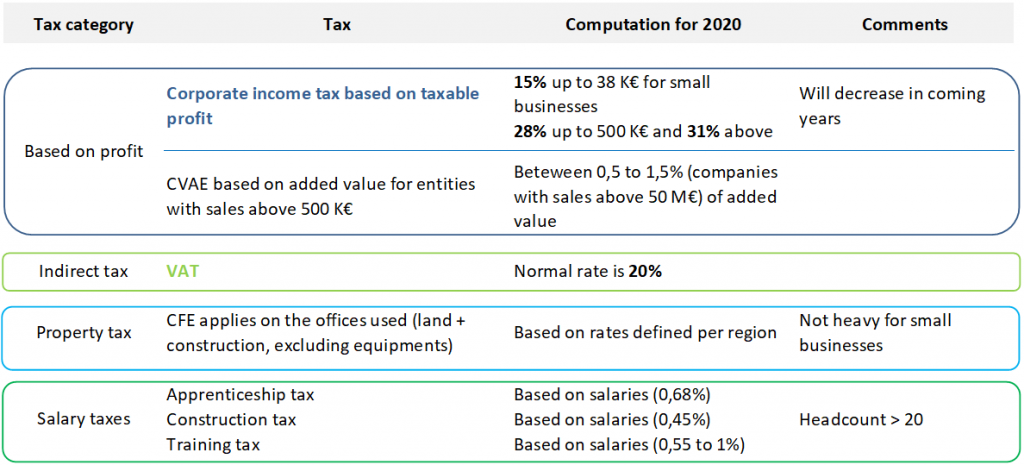

The chart below presents the main business taxes applicable in France for FY20, similar to most country’s tax structures.

Other specific taxes exist on company cars, retail locations, pharmaceutical or energy businesses. Main taxes are CIT and VAT although VAT is normally not a cost for the company.

Corporate income tax evolution

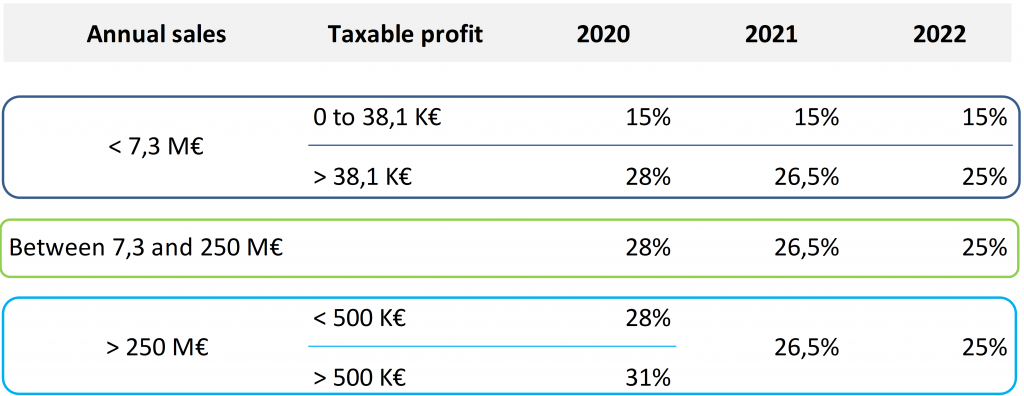

French government has enacted a progressive decrease in corporate income tax rate up to 25% in FY22.

This is a significant decrease from 33,33% in 2016, with the 2022 target (25%) being in the EU benchmark.

Corporate income tax benchmark

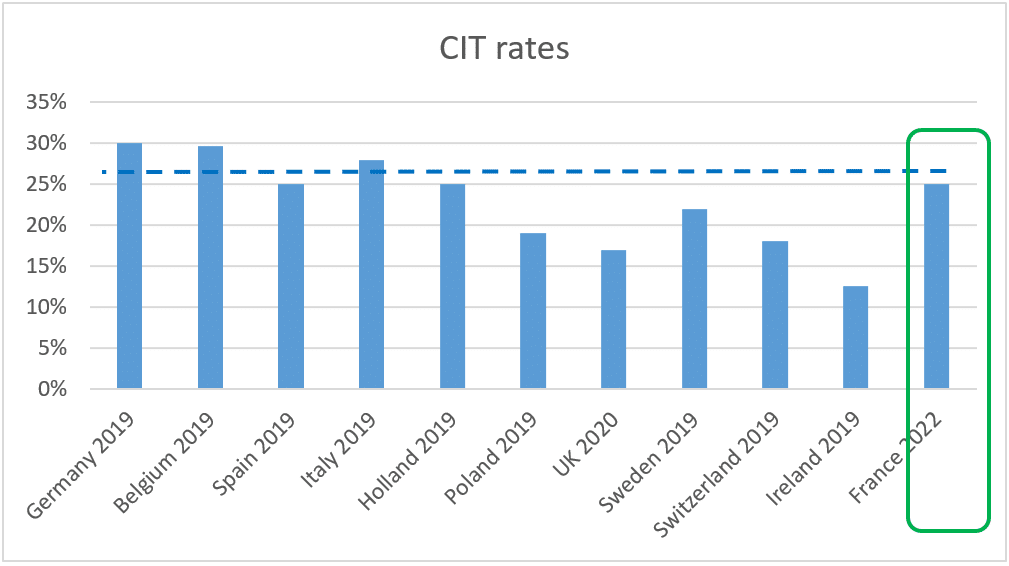

At 25%, the French CIT rate is fully competitive compared with other major EU economies.

Tax incentives

Focus on innovation

For years, the French government has implemented a highly favorable business environment to facilitate the development of innovative businesses. This includes the following significant tax incentives.

R&D tax credit

- 30% tax credit on R&D expenses up to M€ 100 (5% above M€ 100)

Possibility to get reimbursed by the Tax authorities if the company does not pay CIT - Expenses directly allocated to scientific / technical projects in new areas

- Need to prepare a comprehensive documentation covering technical (new areas explored) and financial aspects

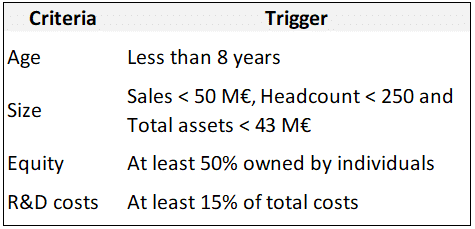

JEI status awarded to innovative companies

- Exemption of CIT (one year and a half) and social contributions on R&D employees

- For companies meeting the conditions in the table opposite

- Requirement of new activity, not being the continuity of an existing one in another company

Innovation tax credit

- Applies to expenses incurred for developing prototypes, new product designs

- Represents 20% of the expenses incurred, limited to K€ 400 per year

Other aspects

Beyond the tax incentives around innovations, the French tax system also includes the following advantages

- Companies are not taxed on capital gains (company shares) and dividends

Shares representing at least 5% percentage of interest, owned at least since 2 years - Reduced income tax rate of 10% on intellectual property incomes

- Extended scope of bilateral tax treaties with 126 countries worldwide allow to limit tax impacts on cross border transactions (dividends, interests, royalties)

- Specific tax treatment on free shares granted to employees, fully applicable to US or UK Restricted Stock Units

- Tax pooling agreement to offset taxable losses and profits for French related entities (Holding and subsidiaries)

- Tax exemption for expatriates on their expatriation bonus as well on their activity abroad

- EU advantages including intra-com VAT regime (no VAT payment on imports within EU), absence of withholding taxes between EU members and neutral tax treatment on internal restructuring

Tax schedule

How does it work for a newcomer?

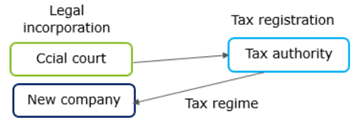

Newcomers are automatically registered with the Tax authority as part of the company incorporation process.

Set-up

- Automated process between commercial court and tax authority

- Option to apply for simplified tax regime

Moving forward: tax schedule

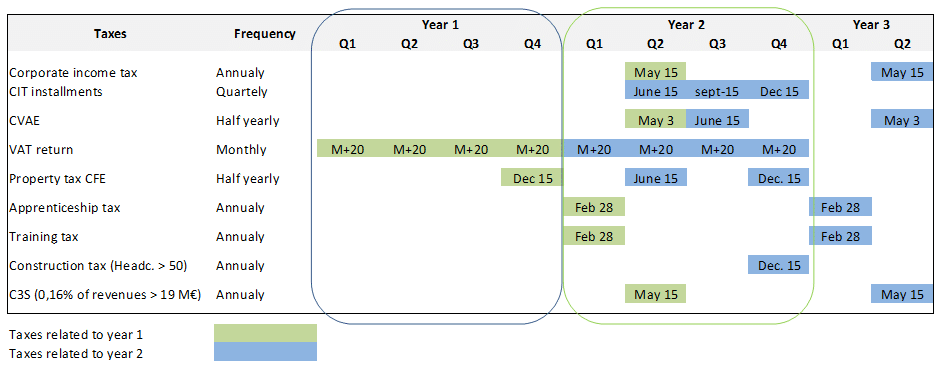

The table below summarizes the tax payments due by a business newly incorporated in France.

Apart from VAT, few payments planned the first year. Potential significant one off tax on new office space construction in Paris region.

How to address usual concerns ?

Main comments on French tax system

Too costly : kill the profits ?

- Corporate income tax rate is decreasing progressively to 25%, a competitive rate within EU

- Lower rate for small businesses: 15% up to 38 K€

- Significant incentives for innovative companies

- Transfer pricing scheme may keep low the taxable profit depending on size and risks of the French operations

- Mechanism of avoiding double taxation on cross border transactions (dividends, royalties and interests)

Too bureaucratic: to much time to spend ?

- Tax registration automated as part of the incorporation process

- Almost all filings and payments done online on the Tax authority website

- Usual communication with tax authority through emails

- Usually 20 declarations per year including the monthly VAT

- Simplified tax regime for small companies

Too rigid: no possible discussion ?

- Tax rules are precisely designed although there are always specific cases with room of interpretations. As a result tax payers can always demonstrate the fairness of their positions and requests

Tax audit is a contradictory process allowing tax payers to defend their positions during the audit and afterward with different possibilities to contest and appeal - Chartered accountants and tax consultants are used to assist the companies against the tax authority and are frequently successful

- When in a difficult cash position, the company has the possibility to negotiate with the Tax authority to reschedule its tax payable

- Usual process to obtain refund of VAT or other tax credits

French government agenda for tax reforms

General trend

Since several years the general orientations of the tax reforms are constant and driven by the following objectives:

- Comply with budget discipline required by UE (deficit limited to 3% of the PIB)

- Improve the economic performances with a trend to lower business taxes

- Fight against tax evasion with rules improving the tracking of business transactions and efficiency of the tax inspections

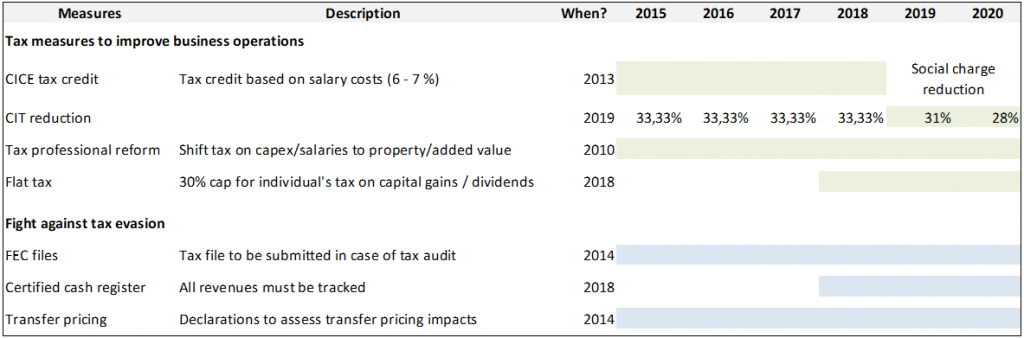

Past key reforms

The table below summarizes the main tax reforms enacted during the past 10 years, all converging on the general goals mentioned above.

Projects on agenda pursue the same objectives although the Covid crisis may change the priorities

Improvement of economic performances

- Planned reduction of corporate income tax up to 25% on 2022

- EU project to harmonize the taxable basis (ACCIS project)

Fight against tax evasion

- Implementation of mandatory electronic invoices will allow the government to better control and collect the VAT: 2023 to 2025

- Require the FEC file to be prepared on a monthly basis and communicated to the Tax authority (not officially planned)

Illustrative business case

Pharmaceutical / software businesses

French tax system provides a very optimized framework with in particular the possibilities to:

- Deduct the acquisition costs through tax pooling agreement (French holding acquiring the French business)

- Finance 30% of R&D activities (R&D tax credit)

- Limit the taxation of IP incomes to 10% (IP specific tax regime)

- Exempt dividends from taxation (regime “mère – fille”)

- Dispose the French business without tax on capital gain

- Significant past acquisitions from US groups were clearly facilitated by this set of favorable tax rules.

By combining the French tax optimizing measures, we assisted US investors who decided that structuring their acquisitions in France was the most efficient thing to do

À propos de L'auteur

Vous avez aimé cet article, vous avez une question ? Laissez un commentaire